The difference between the two costing methods is how the fixed factory overhead costs are treated. Under variable costing, fixed factory overhead costs are expensed in the period in which they are incurred, regardless of whether the product is sold yet. Under absorption costing, fixed factory overhead costs are expensed only when the product is sold. It is a method of costing used to ascertain the cost of manufacturing a standardised product in a single process.

Direct costing

In addition to the above methods of costing, there are certain techniques of costing, which are used along with any of the above method. These techniques serve the special purpose of managerial control and policy. The technique differs from marginal costing because some fixed costs can be considered as direct costs in appropriate circumstances.

Continuous Operation Costing

When you know the true cost of your products, you can navigate the market more effectively, respond to challenges, and keep your business on track for success. Once you’ve decided on the costing method to use, you need to start gathering payback period formula financial calculator cost data and analyzing it. Since ABC considers all manufacturing activities, it provides a very accurate picture of the unit cost. Target costing is a method used to ensure that products are designed and priced to meet customer needs.

Standard Reason or Driver of Activity Cost

This necessitates a larger level of investment in plant and equipment. A manufacturing company’s raw material and packaging costs, or a retail business’ credit card transaction fees or shipping costs, which increase or decrease with sales, are examples of variable costs. The above discussion leads us to the conclusion that cost accounting is a systematic procedure for determining per-unit costs.

How does ABC differ from traditional costing methods?

For each individual contract, account is kept to record related expenses in a separate manner. It is usually followed by concerns involved in construction work, building roads, bridges and buildings etc. Siim Kanne is a production management specialist with more than 15 years of experience in customer-facing roles, sales, onboarding, and technical support. His hands-on experience with thousands of clients and involvement in product development has made him a trusted advisor in the manufacturing software industry.

- The system is used generally in cases where Government happens to be the contractee.

- This method is suitable for transport undertakings, hospitals, educational institutions, etc.

- Variable costs vary directly with the production volume, such as direct materials and direct labor.

- It is used by manufacturing as well as non-manufacturing undertakings which manufacture goods against specific orders.

- If a product passes through different stages, each distinct and well-defined, it is desired to know the cost of production at each stage.

In traditional cost accounting, you usually tally up your overheads and split them evenly across your activities. This can help to understand costs at a glance, but it doesn’t take into account significant variations between activities. For example, one product might require more electricity to produce than another. Direct costing is useful when you want to make short-term business decisions about strategic direction but can be harmful if used for long-term decision-making as it excludes important indirect costs. The specific identification method involves tracking every item bought or produced from the time it enters your business to the time it’s sold. This differentiates it from the FIFO, LIFO and weighted average methods which group costs together.

Estimated costs are definitely future costs and are based on the average of the past actual figures adjusted for anticipated changed in the future. It is an application of more than one method of costing in respect of the same product. This method is used in industries in which a number of components are separately manufactured and assembled to produce a single unit of product. For example, manufacture of different types of components may require different production methods and hence different methods of costing may have to be applied. Assembly of these components into one finished unit may require still another method of costing. (ii) Operation Costing- In this method, each operation, in each stage of production or process is separately costed instead of a process and then the cost of finished unit is computed.

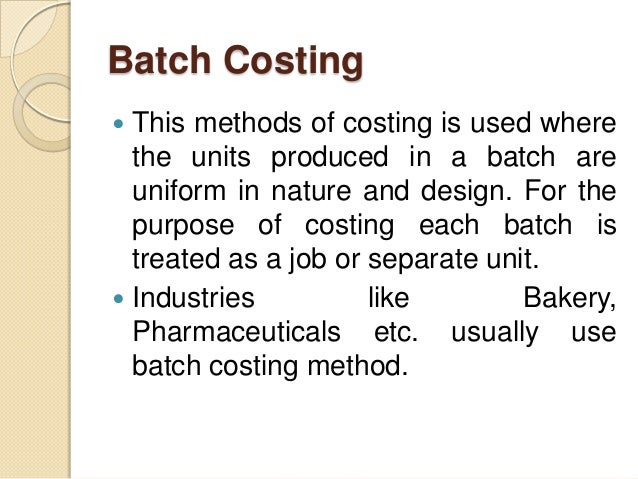

Financial decision-making is based on the impact on the company’s total value stream profitability. Value streams are the profit centers of a company; a profit center is any branch or division that directly adds to a company’s bottom-line profitability. Batch costing is the last method of costing under specific order costing. It is used in a group of the same or similar products which are made and passed through a factor at a specified time and number. Contract costing method of another specific order costing which is not much different than the job costing method.

It is to be noted that basically there are only two methods of costing viz., Job costing and Process costing. Job costing is employed in cases where the items of prime cost (i.e. direct material, direct labour and direct expenses) are traceable to specific jobs or orders, e.g., house building, ship building etc. But where it is impossible to trace the items of prime cost to a particular order because their identity is lost in manufacturing operations, process costing is used. For example, in a refinery where several tonnes of oil are being produced at the same time, the price cost of specific order of 10 tonnes cannot be traced. It is a method of costing used to ascertain the cost of making a single unit of customized product.