Post summary

- Some of the finest profits are made with the homes with deteriorated below neighborhood conditions and certainly will getting affordably refurbished.

- Cosmetics in place of architectural improvements are more worthwhile finally.

- To discover the best efficiency into a potential fixer-top, pick a safe area with relatively large property opinions.

- Have fun with a mortgage analysis provider in order to submit an application for a bigger than just necessary bond, in order to utilize the excess amount with the need renovations.

Where most homeowners are interested a home within the mint condition (just change the key and you may move upright in the), brand new smart contract hunter who would like to create a neat earnings usually thought to buy an excellent fixer-upper.

A beneficial definition of a fixer-higher are property which had been allowed to damage below neighborhood criteria, says Rhys Dyer, President from ooba Lenders, Southern Africa’s prominent investigations service.

Among the great issue from the to purchase a great fixer-upper is the fact that get isnt contingent on the temperature of the home sector, he adds. If hot, cooler otherwise basic when is a good time to buy an effective fixer-upper.

Picking out the most useful fixer-upper

If you are considering investing a home that needs TLC, here a few of the characteristics just be interested in:

step one. A property that needs primarily cosmetic makeup products advancements

You don’t want property that will want too much investment away from you. Select attributes which are often notably enhanced which have cosmetic change for example painting contact ups, drywall solutions, flooring refinishing – which usually prices way less than what they come back for the market value.

Updating your kitchen, which is the cardiovascular system of the property, is especially great at elevating their market price. Bathrooms may also alllow for potentially worthwhile advancements.

Whenever choosing a house to get, overall in the estimated costs for making repairs and put that it number on the price of the home. Upcoming, ensure that you should be able to create a smooth profit whatsoever of them costs, Dyer advises.

dos. The spot

House are fixed and made are worthy of much, more than just the newest worth, nevertheless the place is not something might be altered. Along with looking for a home you could potentially restore and make it more valuable, it’s also advisable to pay attention to the area its into the.

Dyer suggests. For the best productivity, pick a secure neighbourhood that have fairly higher property philosophy. In the event the, however, you are doing will spend money on a beneficial fixer-upper that isn’t throughout the best of elements, you should keep which planned whenever determining just how much to devote to advancements.

step three. Attributes instead of serious problems

Make sure to get a specialist company so you can examine our home, to help you be aware of one architectural problems. After that you can see whether it is worth the financing. Issues including the plumbing work, electronic and you can domestic plumbing are going to be very difficult to handle, if you are damaged window and you can deteriorating painting can be simply repaired.

cuatro. Features which can be probably escalation in market price

Upgrading your house will increase the value by default, however it cannot damage to research the marketplace and find out whether or not cost in the region are usually going up or down. To purchase an excellent fixer-upper from inside the an area where house costs are probably increase gives a great deal more economic potential to disregard the. Likewise, renovating property in the a luxury residential district function you might improve the worthy of when you are however staying its price below the average pricing from the section.

Prepare your funds having a good fixer-higher

One of the payday loans Southern Ute most problematic aspects of to acquire a beneficial fixer-higher is purchasing the fresh new restoration, says Dyer. Understandably, a lot of people don’t possess far additional money right after paying a deposit and you will import can cost you, very creating extra cash to cover solutions or repair will be tough.

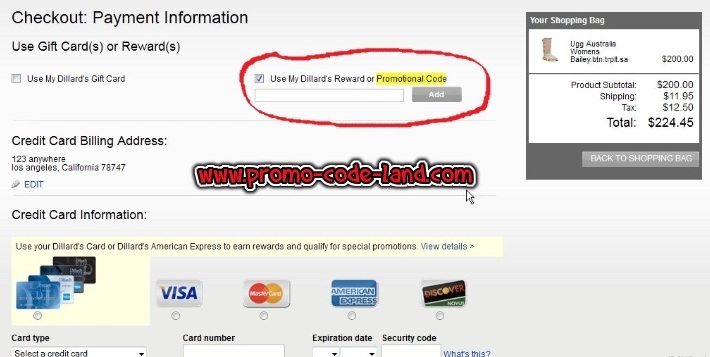

However, another option that you may possibly never be familiar with was, to try to get a larger than required thread, carrying out a surplus number as you are able to availableness on the desired recovery.

When your mortgage bank offers this 1, these money is borrowed resistant to the home’s really worth following efforts are finished, susceptible to borrowing from the bank approval states Dyer.

ooba Home loans covers every aspect of your own application to ensure the loan was canned easily, allowing you to manage painting swatches and you can option dishes all the stuff that will help turn a dull and you may dreary fixer-upper into your own private castle, and, divorce lawyer atlanta, generate a fantastic cash in the act.

When you yourself have your own eyes into the a house that have possibility to make most readily useful fixer-higher, ooba Lenders provide a selection of devices that can make your house purchasing processes convenient. Begin by the Thread Calculator, after that make use of the ooba Lenders Bond Indicator to see which you really can afford. Finally, before you go, you could get a mortgage.