If you’re looking to shop for a house, an FHA financing might be a beneficial option. Let’s go through the loan official certification, for instance the credit history you’ll want to qualify for an enthusiastic FHA financing.

Do you know the minimum credit rating standards to possess a keen FHA loan?

FHA finance can frequently buying control on hand out-of individuals who can get if you don’t has actually a hard time bringing acknowledged to have a home loan which have conventional loan providers. There are a number of positive points to FHA fund, and a lesser downpayment, approval which have narrow borrowing otherwise problems with their credit character, even more funding for home improvements, and much more.

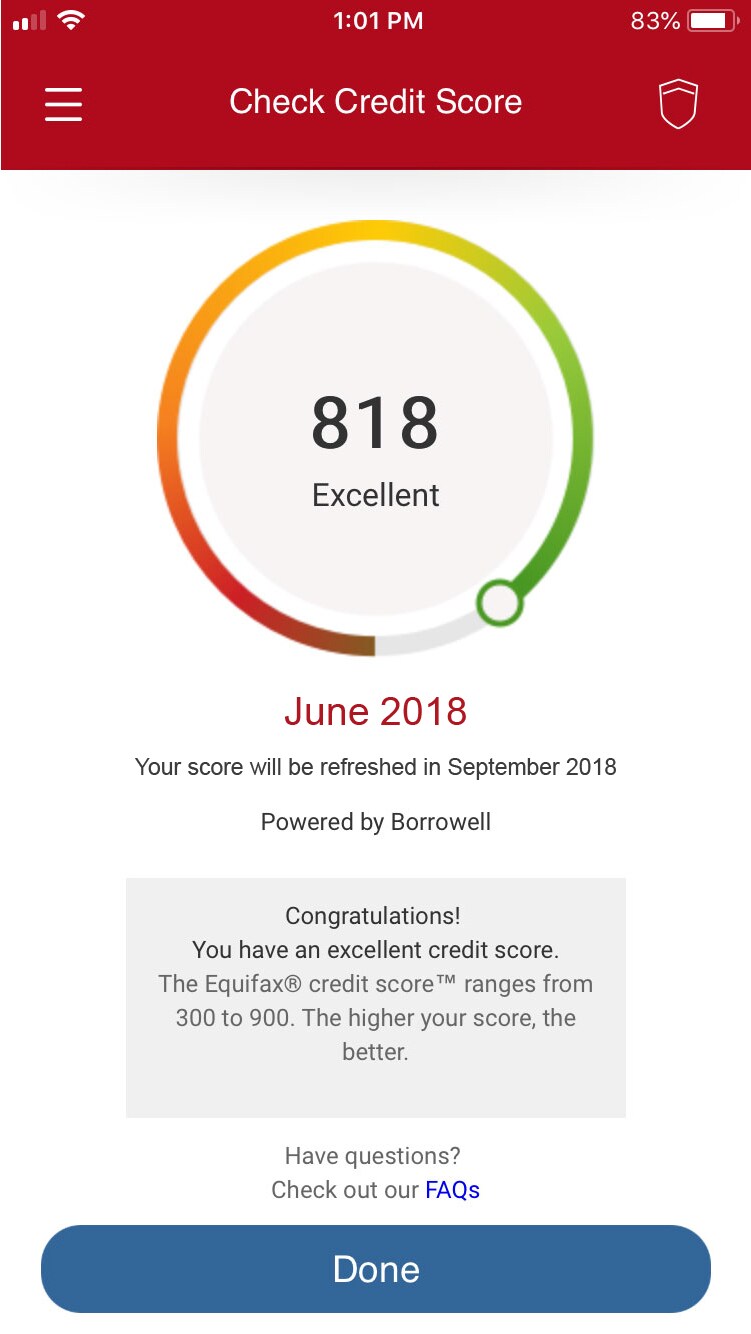

In order to qualify for a keen FHA financing, you’ll want about a four hundred credit history – however, a credit score regarding 580 ‘s the tipping part between having and make a beneficial 10% deposit and being able to make a smaller sized 3.5 percent deposit.

Perhaps you have realized, https://paydayloancolorado.net/georgetown there are a critical amounts of approvals, regardless of credit history ranks. Also among those users that have a credit score lower than 550, the approval rating is nearly forty%.

Exactly why is it important to be aware of the credit standards to own an FHA mortgage?

If you’re seeking to pick property, knowing the various other standards for prominent mortgage sizes can be help you make educated conclusion on what mortgage is the proper choice for you. Wanting a mortgage which works for you will not only enable it to be simpler for you to be accepted, it can also save way too much profit the process.

Source: New questionnaire provided 650 Property owners that have approved mortgage loans. The analysis separated participants of the credit rating and requested them just what variety of financing they received. The fresh poll try taken in .

It’s not hard to notice that traditional mortgages and you may USDA home loan money will be the huge users regarding the online game, representing almost 75% of all of the mortgages acknowledged in the 2017. However, FHA funds were the next most recognized variety of fund, representing almost 17% of the many mortgages acknowledged from inside the 2017.

What is a keen FHA loan?

An FHA mortgage is actually an interest rate guaranteed by FHA, and/or United states Government Homes Administration. Personal loan providers, eg lender otherwise borrowing from the bank unions, situation the mortgage together with FHA brings backing for it – in other words, or even pay off the loan, the fresh FHA often step-in and you will afford the bank as an alternative. Due to this fact guarantee, loan providers be much more ready to build a much bigger mortgage, as well as in instances when they’d be or even unwilling to approve loan requests.

Founded inside 1934 for the High Despair, the Federal Property Government is a national company that provides mortgage insurance rates so you can private lenders. Till the advent of brand new FHA, the us housing marketplace is actually struggling. Below forty eight% possessed home, and you may finance weren’t possible for buyers. For example, consumers had been merely capable money about 50 % of your purchase cost of a house (in place of a little down-payment), after which loans usually expected a big balloon commission immediately after a great few years.

- There are certain positive points to a keen FHA financing, including:

- Quick advance payment (as little as 3.5 %)

- Easier to use gift suggestions for down payment or closing costs

- Assumable fund

- The opportunity to reset less than perfect credit

- Certain FHA money can be used for home improvements

What credit rating do you want to possess a keen FHA mortgage?

You need to have about a 400 credit score in order to qualify for a keen FHA financing. Yet not, a credit history regarding 580 is the tipping section for being capable of making a smaller sized step 3.5 % down-payment, instead of a good ten% deposit.