Purchasing your first home is a huge milestone-one which is sold with a number of critical choice-and come up with and you may a massive monetary obligation. This is why it is critical to prepare before you even look on property. One of many things that you need to do when buying property should be to make certain you have your profit in check. Real estate loan services are plentiful and you may always consult that have a mortgage loan administrator into the Georgia so you can navigate the method.

Do not know where to start? I’ve waiting a simple list that one can make reference to while preparing getting a home pick:

step 1. Look at your deals

How much cash you’ll need commonly mainly confidence the significance of the house you need to get. Off costs generally speaking costs ranging from 10 and you can 20% of home’s well worth.

It is vital to own nice coupons and a spending plan when you look at the spot for a property pick. Otherwise, it is high time to make a tangible plan so you can also be build dollars and you will savings toward pick. The earlier you begin controlling your money when preparing having a household pick, the earlier you could start your own travels toward running your first home.

3. Look at the borrowing from the bank situation

A mortgage manager inside the Georgia will appear at the many different issues so you’re able to determine an appropriate financing speed for you. Such situations have a tendency to range from the quantity of coupons you may have and you may makes readily available for an initial commission on a house, possible risks for the living otherwise revenue stream, and get notably, your credit rating. All the area your credit rating is actually shy from 800, you are going to shell out a whole lot more for the appeal. In order that the borrowing is prepared getting a house mortgage, its smart to evaluate and monitoring your credit history, paying the money you owe (if any), and you will reading aside financial issues, that can most of the make it easier to look after good credit.

Because of the assessing your money, possible dictate simply how much you can afford to invest with the a mortgage. Home mortgage functions can be very useful in determining the way you is manage your money because you pursue a property pick. Aside from your credit rating, loan providers generally account fully for additional factors to determine what you can do to pay off their home loan, just like your income, the month-to-month expenses, your own financial comments, etc.

5. Are you experiencing a place in your mind?

Now that you recognize how far house you really can afford, it loan places Douglas is the right time to consider your selection in terms of area plus the particular assets we would like to inhabit.

Generate a listing of the things you want to possess inside the yet another family such as the number of bed rooms, baths, driveway area, outdoor services, plus improvement prospective for example a cellar which might be converted with the a property gym or at least a business. These details normally perfectly make it easier to narrow down your options.

When it comes to location, think areas that will be next to that which you might need availability so you can within this a residential area. Look into the safety together with general character of one’s related town, eg its offense statistics, this new features available in community, as well as the transport links obtainable in and you can from the room.

6pare costs

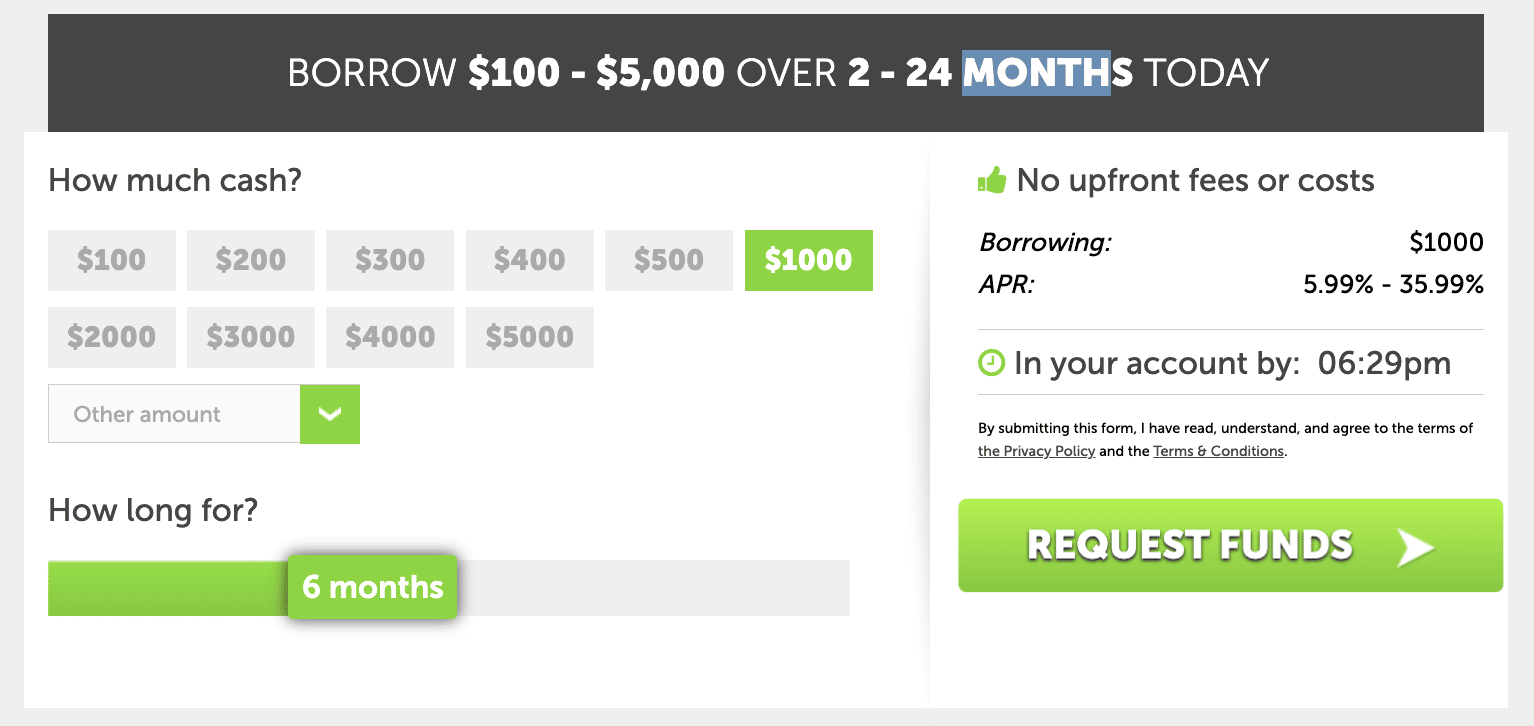

When looking for a property, you want to get the very best contract from the get. Therefore it pays to try to get several financing so you simply will not have to be pinning the dreams to the a single home loan origin. This will and offer the chances to contrast pricing and you will get the best deal from your selected financial.

When considering taking right out home financing on your own very first household, it’s very important to get available to a requiring loans. Queensborough National Bank normally make suggestions so you can an experienced and you may experienced home mortgage manager into the Georgia who will direct you as a consequence of all of the the borrowed funds mortgage functions that the financial and trust team also provides. The company considers it a great privilege to be able to assist you with your home get as a consequence of different kinds of mortgage and you may mortgage features they have to be had.